Project

Open Access MFT

Genre

Speculative prototype

Client

Internal

Initiated

2012

Algorithmic trading accounts for the majority of trades on the stock market. It brings more volume and liquidity and, some would argue, instability to the market. Certain flavours of automated arbitrage, like high frequency trading, happen order magnitude faster than timescales human can even percieve. That we allow machines and weak AI to handle our resources in this fashion seems a uniquely current phenomena. See the movie, read the book, reel at the implications.

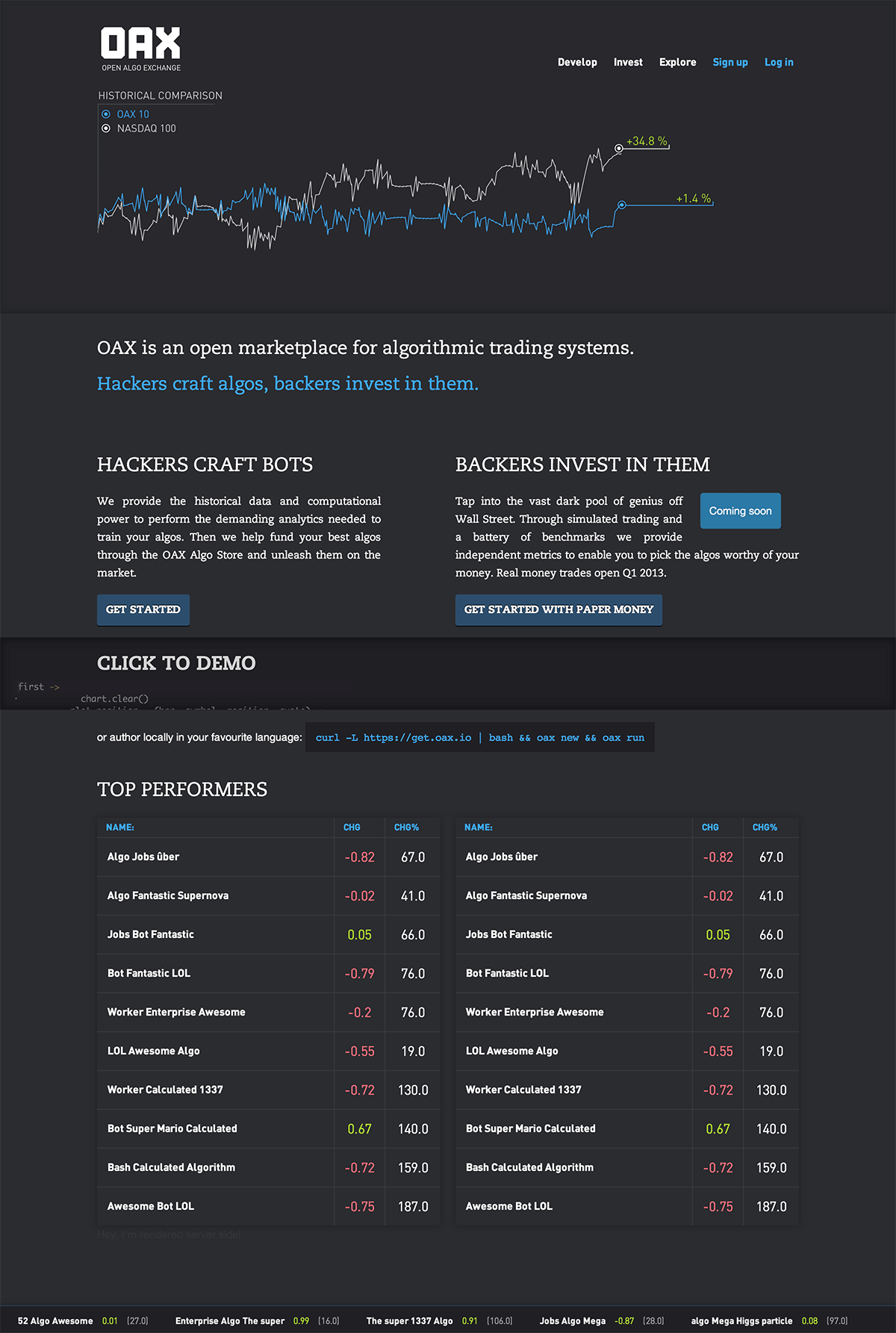

In 2012 we noticed that this market operates under an intrinsic inefficiency – only institutions with capital to invest have the funds to build the infrastructures to carry out automated trading at scale. This is of course beneficial to large investment banks, but clearly sub-optimal. Wall Street has efficiently drained the workforce of people who could otherwise be furthering the human condition. But we think there may still be people left in the world who can rock their linear algerbra and machine learning at night while working day jobs. These people could be gainfully employed writing money making machines on the sly.

This is a classic case of a situation just waiting for a bit of disintermedion. Capital could be decoupled from the ability to craft automated trading systems. Hackers could be given tools to write algorithms, backtest them on historical data and benchmark them on live market data in sandboxed environments. Backers could be given the opportunity to invest in top performers. Like they were horses at the races.

We bought 10 years of NASDAQ data in one minute resolution and stuffed it in HBase, wrote connectors to stream it to algos and built wee virtual machines to safely encapsulate client's algorithms. We even built a javascript console to allow potential users to backtest algos written in coffeescript right in the browser. We sketched logos. Built prototypes. Talked to people in well tailored suits that did banking infrastructure.

In the end we decided not to pursue OAX. Mostly as we – after really looking into it, then mulling it over – think the practice of medium to high frequency trading should be abolished. Not to worry, though: Lately two separate companies, Quantopian and Collective2, have started building similar offerings.

Other projects

-

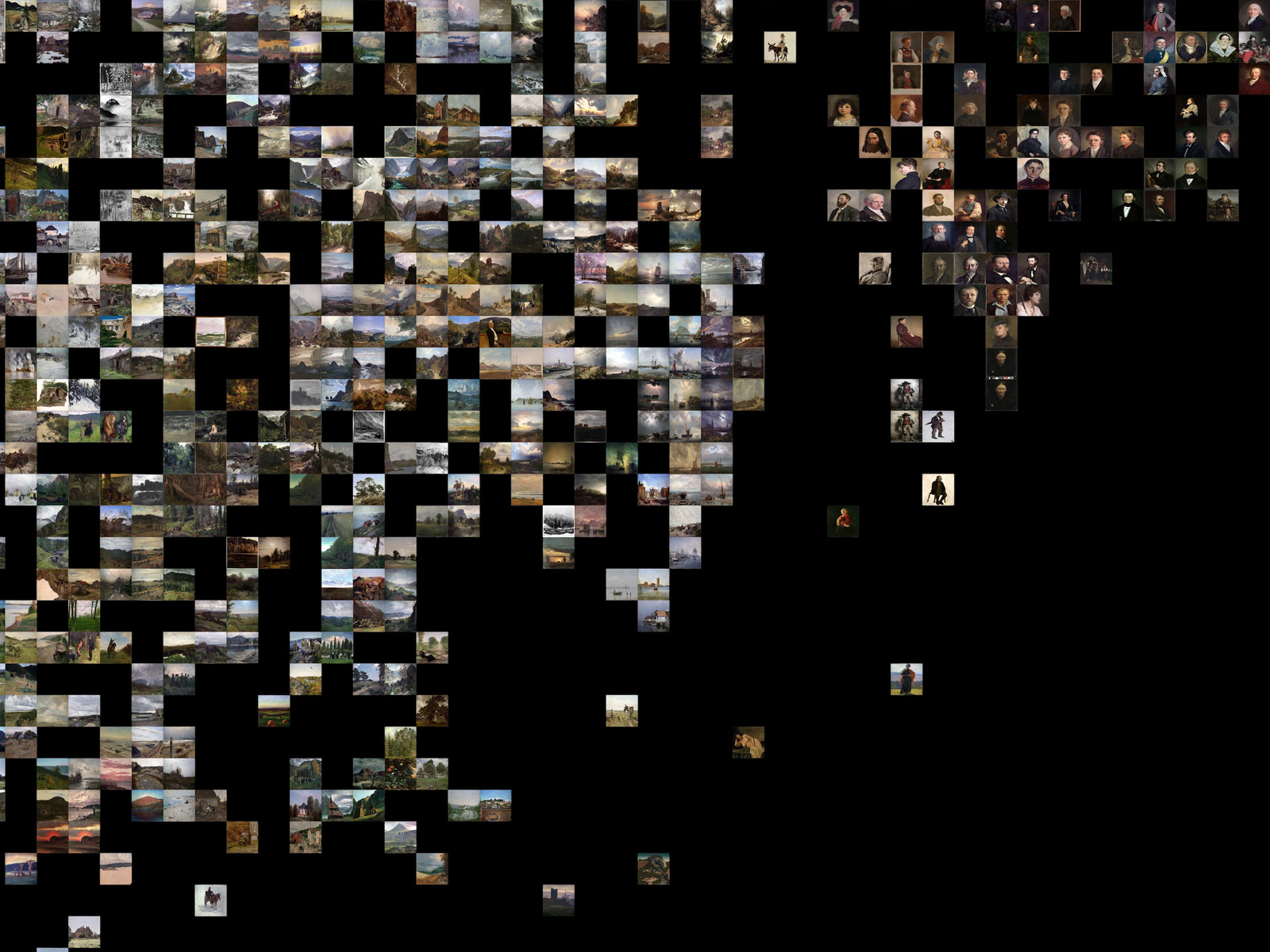

Principal Components

Machine learning in search of the uncanny

-

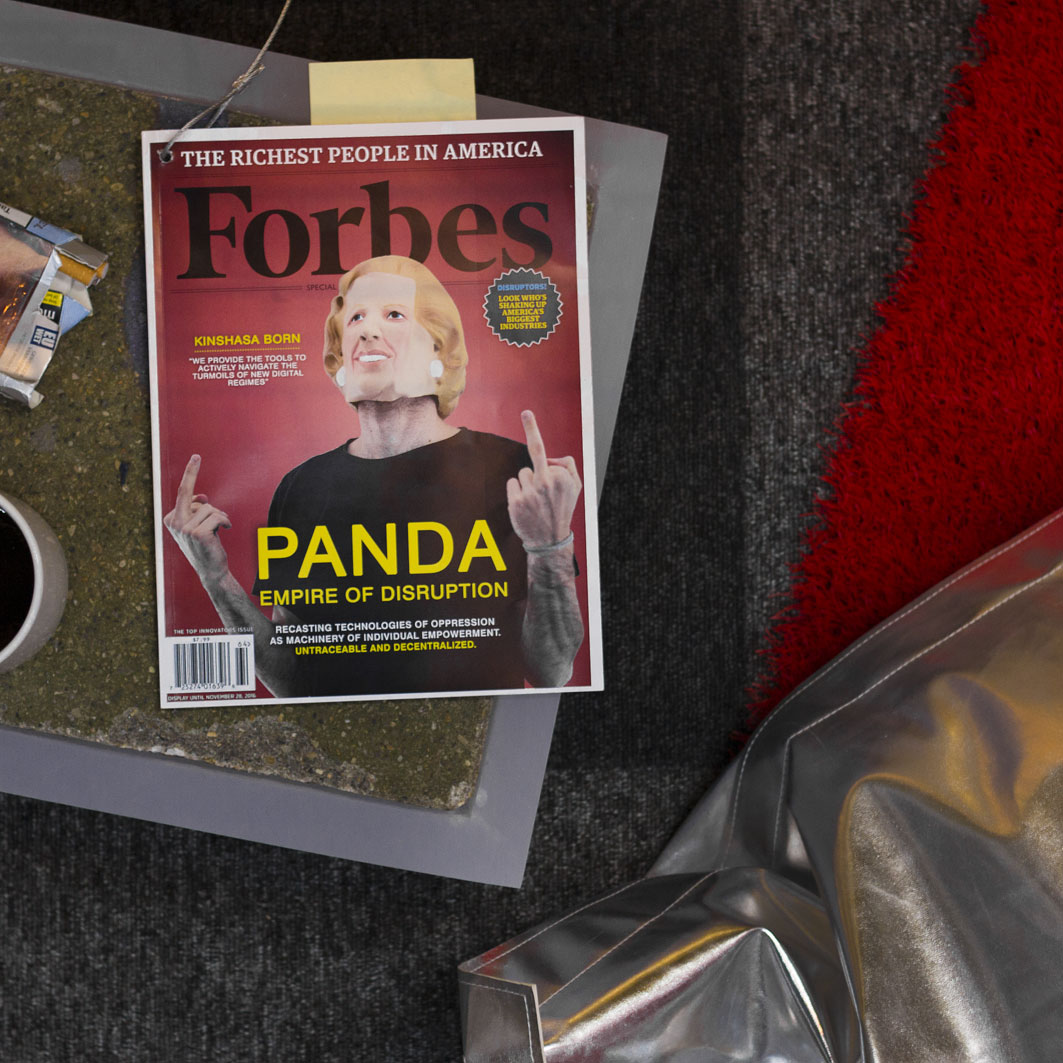

PANDA

Supercolluder for the gig economy

-

OMA Website

Simple surface, intricate clockwork

-

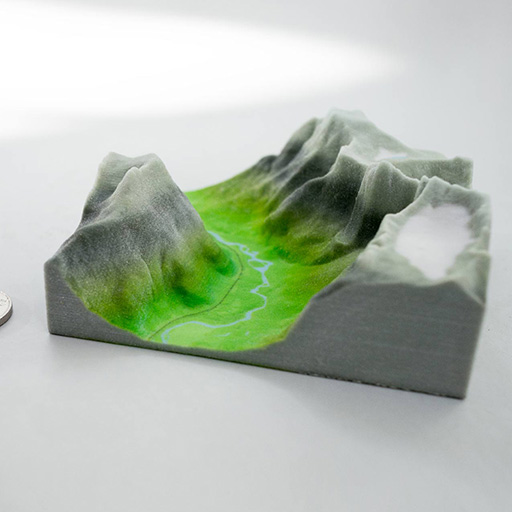

Terrafab

Own a small slice of Norway

-

Mapfest!

Helping liberate Norwegian geodata

-

Underskog

Friendly community for the Norwegian cultural fringe.

-

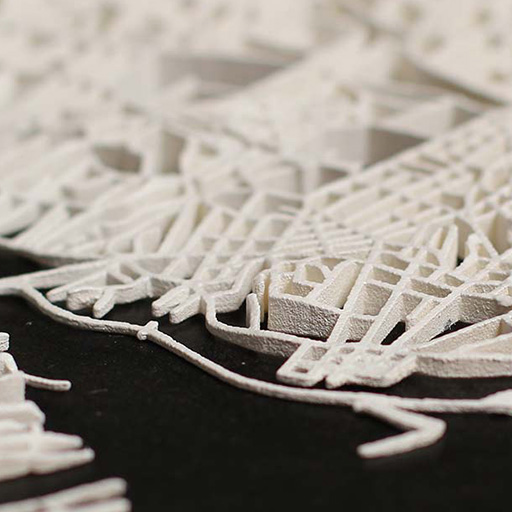

Intersections

Laser sintered topological maps for cars and social scientists

-

Chorderoy

Efficient text input for mobile and wearable devices